Nigerians are not so sure about whether they want petrol subsidy payment to continue or not

)

When it comes to the thorny subject of whether the President Muhammadu Buhari-led federal government should continue paying for subsidies on petrol or allow market forces to determine the pump price of the product, there is no clear consensus, it appears.

The federal government has repeatedly announced that it is ending a corruption-riddled subsidy regime, where the difference in the landing cost and retail price of the product is offset by Abuja.

The federal government doles out close to a trillion Naira on petrol subsidies annually, an amount government officials argue should be used to equip schools, hospitals or erect critical infrastructure.

Ending the subsidy regime forever

In April, Group Managing Director (GMD) of the Nigerian National Petroleum Corporation (NNPC), Malam Mele Kyari, disclosed that the subsidy regime will be gone forever and that Nigerians will henceforth pay the market price for the product.

“There is no subsidy and it is zero forever, going forward there will be no resort to either subsidy or under recovery of any nature.

![Group Managing Director, Nigerian National Petroleum Corporation (NNPC), Mele Kolo Kyari. [Twitter/@MKKyari]](https://image.api.sportal365.com/process/smp-images-production/pulse.ng/17082024/6712e30b-a62d-4787-8919-6f6bd903b254)

“NNPC will play in the marketplace, it will just be another marketer in the space. But we will be there for the country to sustain security of supply at market price,” Kyari said.

On Wednesday, September 2, 2020, the Petroleum Products Marketing Company (PPMC) announced that the new pump price of petrol will be N151 from a previous high of N145, in line with the government’s new deregulation policy.

Social media poll result

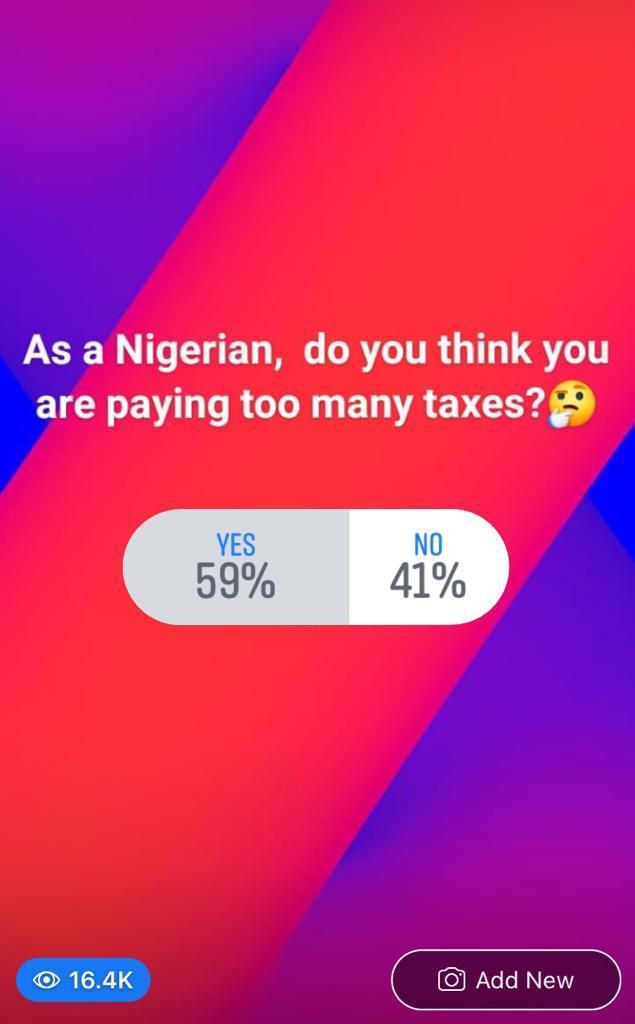

Some social media users have criticized the price hike, amid the damage to the economy by the coronavirus outbreak, multiple taxation and a hike in electricity tariff.

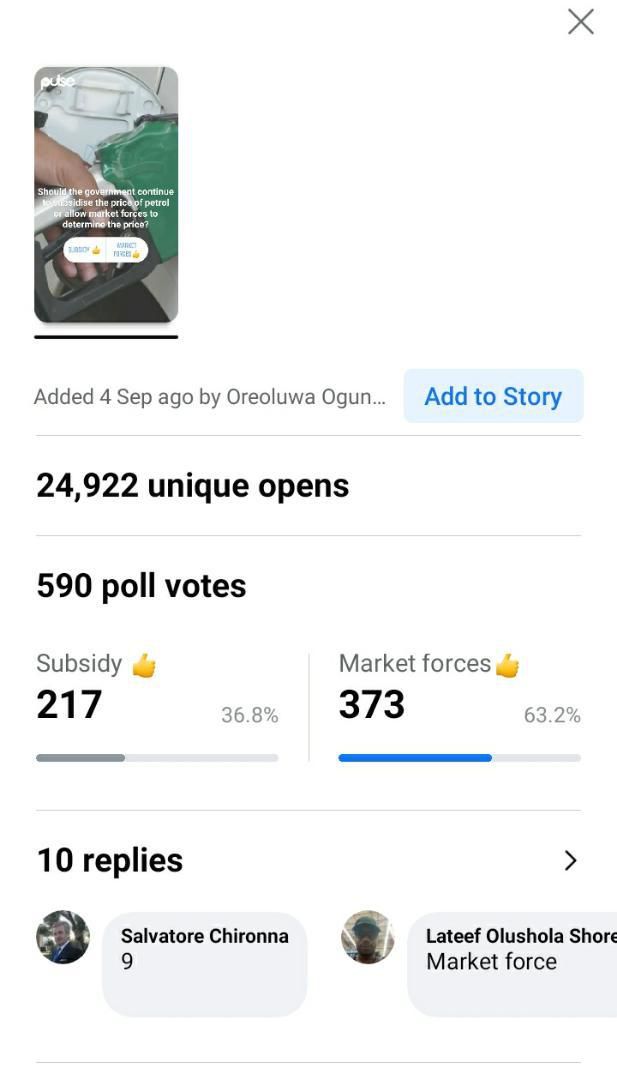

When Pulse asked our social media audience about whether the federal government should revert to subsidizing petrol price or allow demand and supply to determine the pump price of the product, the outcome turned out too close to call.

On Facebook, 63.2% of respondents said the federal government should allow market forces to determine the price of petrol, while 36.8% voted for the continuation of the subsidy regime.

On Twitter, 36.8% asked the Buhari-led federal government to continue paying for petrol subsidy, 31.6% called for an end to the subsidy regime, while 31.6% said they are indifferent on the subject.

On Instagram, an overwhelming 64% want the subsidy regime retained, with 36% voting for deregulation.

Bloomberg reports that deregulation will save the Buhari administration at least $2 billion a year, at a time when Africa’s biggest crude oil producer needs all the funds it can get to revive an economy badly hit by the COVID-19 outbreak.

![President Muhammadu Buhari. [Twitter/@BashirAhamaad]](https://image.api.sportal365.com/process/smp-images-production/pulse.ng/17082024/8d96d7eb-bc51-4878-bf47-56844428c1c7)

Ending the subsidy regime is also a politically dangerous move -- a string of rebounds in global oil prices could rouse the opposition and test the administration’s resilience.

Previous attempts, noticeably in 2012, to wean Nigerians off cheap gasoline led to major anti-government protests.

All of Nigeria's refineries are near-comatose, functioning at a fraction of their installed capacities, meaning that Africa's number one oil producer has to export crude oil and import the finished product for domestic consumption.

)

)

)

)

)

)

)

)

)

)

)

)

)