The Naira is suffering so badly right now, here’s why you should be worried [Pulse Explainer]

)

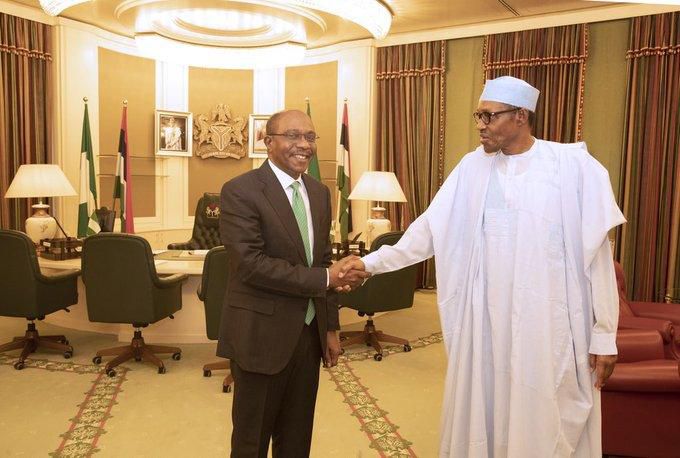

The Central Bank of Nigeria (CBN) has been holding on to scarce foreign currencies in its coffers, in order to shore up the Naira and prevent a depletion of the nation's foreign reserves.

However, this hasn’t stopped the country’s currency from weakening further against the dollar, for instance.

This week, the Pound Sterling is exchanging for N610 and the Euro trades for N550.

The Naira fell 1.04% on Tuesday, August 18, 2020, to a low of N480 to the dollar on the black market.

This comes after the federal government announced that it will reopen airports for international travel on August 29--a move that will increase demand for scarce dollars.

Investors and importers can't find dollars to buy

The Naira had been stable for over a week on the black market at N475 to the dollar, where it traded at more than 20% weaker to the official over-the-counter spot market.

As the Naira continues its free fall, the CBN is refusing to dispense forex (foreign exchange) to investors and importers.

The CBN is fighting against a depletion of the nation’s foreign-exchange reserves which currently stands at around $35.6 billion.

Holders of Nigerian bonds and equities may have as much as $2.5 billion trapped in the country, Simon Kitchen, an analyst with EFG Hermes, said in a note to investors last week.

According to Ayodele Salami who is the Chief Investment Officer at Duet Group, “We’ve been investing across African markets for about 15 years. And in 15 years, Nigeria is the only place where twice in less than five years you have a lockdown or a complete freeze of the foreign-exchange market.”

What this means is that foreign investors who want to buy into the Nigerian market, can’t move their cash out.

Guaranty Trust Bank (GTB) has just announced that payment of dividends to holders of Global Depository Receipts (GDRs) will be put on hold due to difficulties in procuring dollars.

In March, the Central Bank suspended forex sales to retail currency bureaus that resell hard currency to individual users who want to pay for stuff like medical bills and school fees abroad.

Why is the Naira suffering?

The COVID-19 pandemic (with all the lockdowns it ushered) and a slump in the price of crude oil in the international market are the reasons why Nigeria’s Naira is weakening by the day.

Every nation on the planet (Nigeria's trading partners inclusive) was affected by COVID-19, so this was coming.

Oil accounts for 95% of Nigeria's foreign exchange earnings and 80% of budgetary revenue.

Brent crude now trades at $45 a barrel, way below Nigeria's budget benchmark.

What is devaluation?

The Naira has been devalued twice in recent times, stretching the Central Bank’s ability to defend it.

A devaluation is the deliberate downward adjustment of the value of a country's currency relative to another currency.

Devaluation reduces the cost of a country's exports, rendering them more competitive in the global market.

However, devaluation also increases the cost of imports, which means that domestic consumers are less likely to purchase these imports.

Because exports increase and imports decrease when you devalue, this leads to a better balance of payments and reduced trade deficits.

A country that devalues its currency does so to reduce its deficit and improve local production.

How does dollar shortage lead to inflation?

When you visit the markets these days and ask why the price of an item has gone up, what you hear is, "Ah, na because dollar don rise."

If few people can access badly needed dollars or forex to trade, there will be a boom in the black market and a sharp increase in exchange rates.

Nigeria is largely still an import dependent economy that needs all the forex it can lay its hands on to purchase goods and machinery from abroad.

With this dollar shortage, expect prices of foodstuff, groceries and just about everything else, to continue to rise.

![Sellers in the market [Happening Now]](https://image.api.sportal365.com/process/smp-images-production/pulse.ng/17082024/b7b84f65-7b03-484a-ad2e-5fc2db11ff21)

According to latest data from the National Bureau of Statistics (NBS), inflation has risen to 12.82% (year-on-year).

The latest headline inflation is the highest since 13.34% was recorded in March 2018, and this is the 11th straight month that Nigeria's inflation numbers have consistently risen.

)

)

)

)

)

)

)

)

)

)

)

)

)