From the naira redesign and cashless policy to dollar scarcity and restrictions on naira cards, add the constant fluctuations in the value of the naira and you see that we have been through a lot this year.

Since the Central Bank of Nigeria's policy to restrict dollar spending, a lot of Nigerians have had trouble paying for subscriptions like Netflix and other online transactions. In all these troubles, one thing that has become clearer in the past couple of years is that neo-banks and their fintech solutions are desperately needed.

When I was stranded after an Uber ride and the USSD code of the bank I've used since 2010 wasn’t working, my digital bank came to the rescue. When naira was scarce and I couldn’t find the cash to buy meat at the market, I was delighted when the butcher mentioned that he had newly opened a digital account with the help of the banking agent under the umbrella next to him.

Fintechs have come in handy in the past couple of years and especially this year for Nigerians. Financial services in Nigeria and Africa as a whole have been witnessing an evolution via tech in recent years and funding has poured into the sector to promote these ideas.

In these times Kredi Bank, the all-in-one digital-first bank, has been listening, adapting, and simplifying banking for its customers. By all-in-one, I mean that they provide essential banking services, including savings, loans, investments, and POS services for all personal finance and business banking needs, all from one unified platform.

Founded in 2019 by Afolabi Abimbola and Samuel Orji, Kredi Bank was created to provide seamless banking and financial freedom to its customers. They do this through a number of wealth management and financial planning tools but for this article, I’ll introduce two of their great products;

Kredi Savings

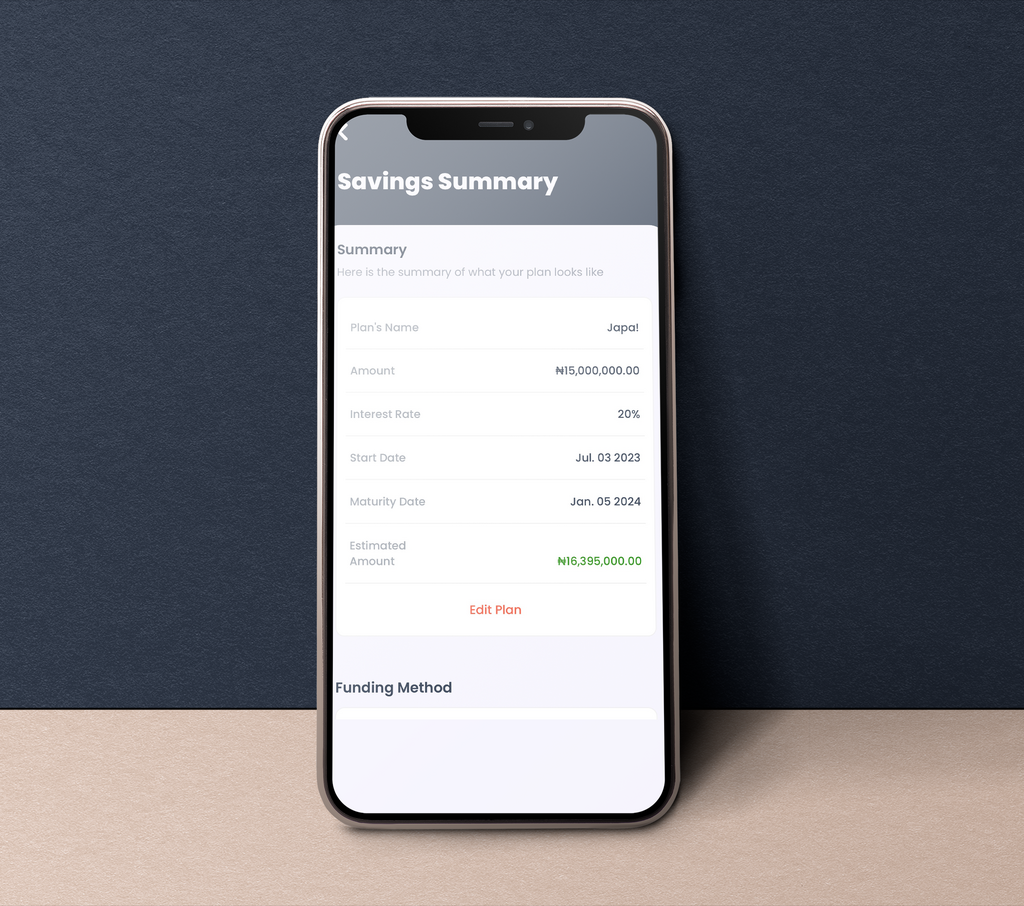

This is a high-yield savings feature. What makes it stand out from other savings features I have used before is that they offer up to 20% interest per annum. Leaving money untouched in a bank these days will cost you money. Between bank charges, CBN duties, and naira fluctuations, money not being used is money losing its value by the hour. Kredi aims to change this with its savings structure with zero maintenance fees.

This product is split into two services; there is the Kredi Pot and the Kredi Vault. Kredi Vault lets you “safelock” your money for an extended period. You save and manage money better without the temptation of breaking it. The longer you save, the higher your interest. Kredi Pot, on the other hand, is for your money goals. If you want to buy a car, a house, or a pair of sneakers you saw online, Kredi Pot will help you set and keep to this goal, and get you there faster with interest. Kredi is also licensed by CBN and all deposits are insured by NDIC

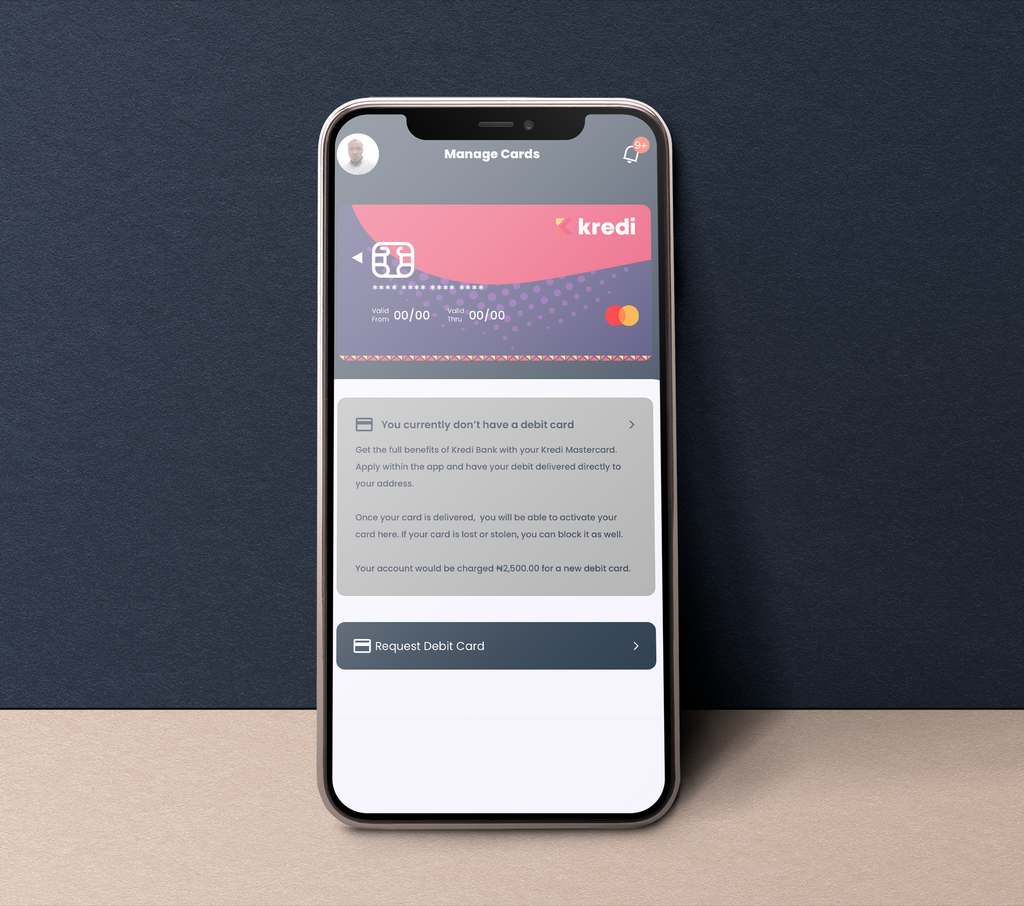

Kredi MasterCard

This feature eliminates any troubles customers have with banking online. Kredi MasterCard allows you to pay for online transactions, pay subscriptions for Netflix and Amazon Prime, and also make withdrawals. Customers also get free merchandise with their MasterCard. As a working writer, I love free stuff and I love a free tote bag even more. You get a customised tote bag, a shirt, and a pen when you request a MasterCard from Kredi.

Kredi also offers loans, funds transfers, and bill payment services on its platform. Customers can get access to all their services from the comfort of their phone. All you have to do is register, verify your identity with a photo, and then you get access to all these wonderful services immediately. The company is on a mission to find customers’ banking pain points and fix them and that's why they offer flexible savings with great interests.

According to a company spokesperson, “At the heart of our product development process is a deep understanding of our customers' needs, desires, and aspirations. We recognised that today's customers crave a seamless and convenient financial experience that seamlessly integrates into their daily lives. We listened to their feedback, studied their behaviours, and embarked on a mission to transform the way they interact with their finances. We understand the importance of saving for the future, and our savings product empowers you to build a solid financial foundation with ease.”

In future, the company is looking to introduce an insurance product, agency banking services, and a payment and collection system. For now, customers can get better financial planning tools, or save for retirement and ultimately experience financial freedom by signing up to Kredi Bank.

---

#FeaturebyKrediBank

)

)

)

)

)

)

)

)