How poor are Nigerians? Report reveals how much Nigerians earn, save and spend

![How poor are Nigerians? [istockphoto]](https://image.api.sportal365.com/process/smp-images-production/pulse.ng/26072024/53c91a78-abe1-4196-92d7-099c16e598d3?operations=autocrop(700:467))

Savings and investment app Piggyvest, with over 4 million users, conducted a survey to find out how Nigerians spend and save their money.

Preexisting data provided by the National Bureau of Statistics reveal that “in Nigeria, 40.1% of people are poor according to the 2018/19 national monetary poverty line, and 63% are multidimensionally poor according to the National MPI 2022. Multidimensional poverty is higher in rural areas, where 72% of people are poor, compared to 42% of people in urban areas.” There's no doubt that this figure will increase this year.

This was the result of the survey done by Piggyvest:

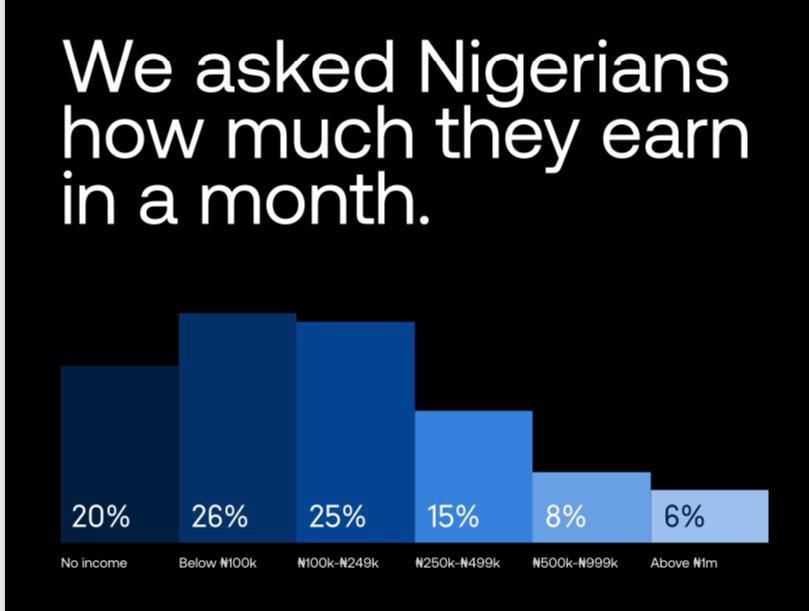

26% of Nigerians earn below ₦100,000 monthly

The majority of Nigerians, 80%, claim to earn an income, with nearly 3 in 10 earning below ₦100,000. These individuals often rely on family, borrowing, or multiple jobs to supplement their salary.

Over 3 in 5 earn a monthly income, while almost 2 in 5 have two or more streams of income.

Gen Z, who has only been in the workforce for a few years, is the least likely generation to have multiple income streams. The group over the age of 57 is the most likely to have two or more income streams.

Nigerians spend more money on food than anything else

![Nigerians personal expenses [Piggyvest]](https://image.api.sportal365.com/process/smp-images-production/pulse.ng/26072024/c8920e1f-25e5-4fbf-a306-2e112308e4da)

Most income is spent on food and groceries, with 87% of respondents naming food as their most important expense. 87% of respondents stated food on their list of most important expenses, followed by utility bills (58%), transportation (48%), and housing (39%).

Nigerians save most of their money to pay rent

![Nigerians saving goals [Piggyvest]](https://image.api.sportal365.com/process/smp-images-production/pulse.ng/26072024/358d4dd8-27fb-4673-a399-4d0ffb2bb2dd)

A study in Nigeria found that rent/housing is the top category of savings for 36% of the population, followed by personal education (24%), japa (21%), vacation (20%), gadgets (17%), children (14%), and a car (14%).

Nigerians try to save but don’t have emergency funds

Older Nigerians are better prepared for emergencies, while Gen Z and Millennials show the least financial preparedness, with only 1 in 25 and 1 in 10 having emergency funds to last 6 months or more.

Nigeria's private savings rate is a significant concern. This is due to factors such as a lack of money and knowledge about saving or not considering saving a priority. However, 79% of respondents have a savings culture, with 64% saving monthly. Also, women save more money than men.

Nearly six in 10 Nigerians lack emergency funds, which protect regular savings and allow for emergencies without incurring debt. But only 25% of income earners have enough to last the recommended period. The majority of those with emergency funds believe their set-aside funds will last only a few months before they run out of money.

This report is hardly a surprise, as government policy has caused economic hardship for many Nigerians.

)

)

)

)

)

)

)