Nova Bank promises jobs, commences commercial bank operations with new branch

)

After a successful five-year run in the merchant banking space, Nova Bank has transitioned into a full-fledged national commercial bank with promises of jobs and world-class, innovation-driven services to Nigerians.

On Tuesday, July 16, 2024, Nova held a ceremony for the official opening of its first branch as a national commercial bank. The edifice, equipped with cutting-edge facilities, is situated on Kofo Abayomi Street in Lagos State.

Formerly known as Nova Merchant Bank, the bank commenced commercial operations having received the requisite licence from the Central Bank of Nigeria (CBN) early this year.

Speaking to Pulse at the auspicious event, Board Chairman and founder, Philip Oduoza, said the bank decided to go commercial last year after the shareholders brought in additional capital needed for the transition.

With the new venture, the financial institution has set a goal to capture a broader customer base, reaching retail and Small and Medium Enterprises (SME) markets.

To make that possible, Oduoza highlighted three key areas of impact, including financial services provision, empowering consumers through credit, and offering a suite of successful products.

“I feel very excited about it because this is something that we have been looking up to, for some time.

"We have been very successful in the Merchant banking space, which is the space where you attend to wholesale banking clients and corporate commercial banking. Now we have turned around, to take this success story to the retail market, and the retail market has far more population than the wholesale space.

"So we want to take this excellent service to many more people in Nigeria because we know it is going to make an impact on the economy," he said.

Nova Bank introduces phygital model

At the heart of this, however, is the introduction of Nova Bank's unique innovative concept dubbed Phygital - a model that allows for the convergence of physical offices and digital platforms for greater customer empowerment.

The Board Chairman described the model as a critical element that ensures consumer convenience and satisfaction.

He added that the plan is to open up more branches across the country, with one in Ikeja and Apapa coming on stream very soon before fanning out to Port Harcourt and Abuja.

He noted that the bank is committed to supporting President Bola Tinubu's administration in the area of job creation and economic stability while stressing its unwavering dedication to delivering exceptional services.

“As we expand our services, we remain dedicated to delivering an unparalleled banking experience that seamlessly integrates the physical and digital realms.

“Our trademarked PHYGITAL experience combines a select number of strategically located physical branches with high-tech, seamless digital banking capabilities, ensuring that our customers receive the best of both worlds. This approach allows us to provide personalised, in-person service where it is most needed, while also offering the convenience and efficiency of cutting-edge digital solutions,” he explained.

Answering questions on the latest 500 hundred billion naira banking sector recapitalisation requirements, Oduoza said shareholders have pledged to provide the fund via rights issue before the CBN deadline.

Nova Bank ready for the next growth phase

Confirming the founder's statement, Wale Oyedeji, the Managing Director/CEO of Nova Bank said, “Last year, our shareholders brought in additional capital, enabling us to scale the hurdles necessary to operate as a commercial bank.

"They have committed to bringing in further capital via a rights issue to ensure we meet the required capital before the CBN deadline.”

Oyedeji added: “For over half a decade, NOVA has been instrumental to the success of leading corporates and high-net-worth individuals, delivering tailored solutions to meet the unique needs of their businesses. As we evolve to serve a broader customer base, we remain committed to delivering innovative services, building on our legacy as a leading merchant bank.

“Through disruptive, seamless digital products and services, we are poised to deepen financial inclusion, provide convenient and secure banking solutions, and elevate the SME market as a key economic driver.”

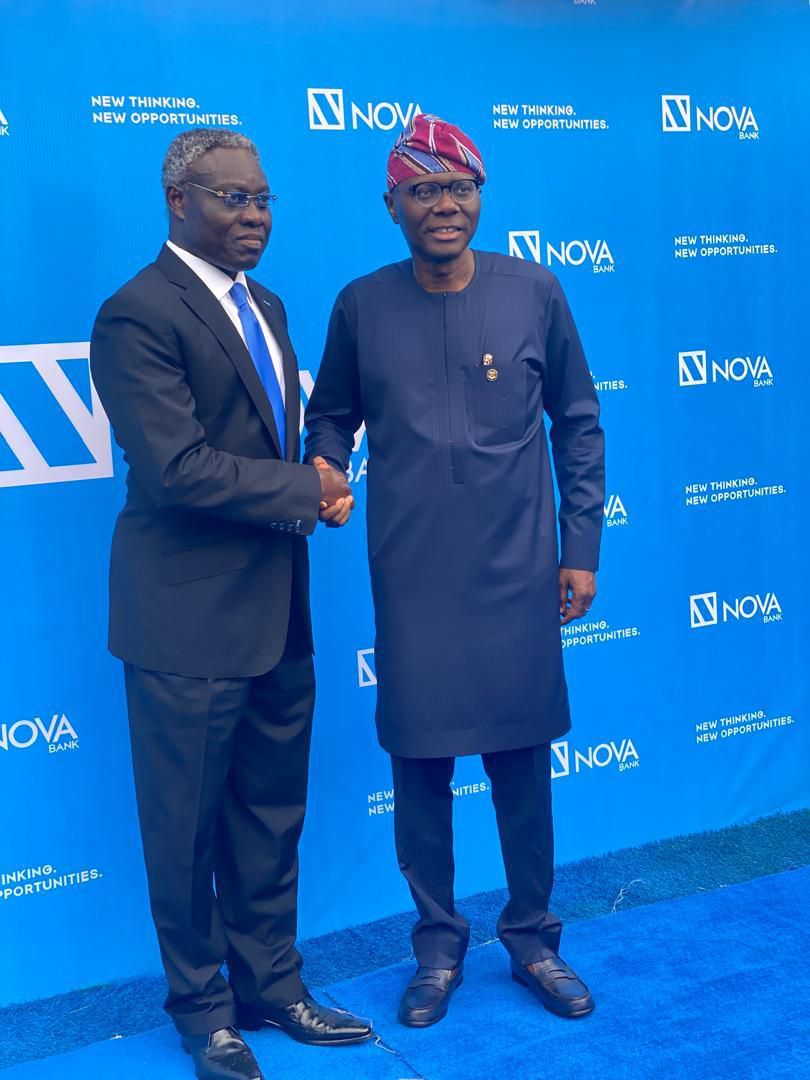

Sanwo-Olu commends Nova Bank

While commending Nova Bank for choosing Lagos as the launchpad of its commercial operations, Governor Babajide Sanwo-Olu highlighted the dedication of investors and shareholders who remain committed to investing in the country despite the economic challenges.

“We need to commend them. We need to encourage them. The NOVA team have a choice to go elsewhere or to remain in the merchant banking space. But they decided to take it further, and taking it further means they have to commit additional resources that will enable them to remain competitive and to make more impact.

“So on behalf of the Lagos State government, I am here to thank you, encourage you and say to you that we are excited about this milestone,“ the Governor said.

)

)

)

)

)

)

)

)

)

)

)

)

)