In the wake of recent mergers and acquisitions, the two lenders have been jotted to action and are now working overtime to stay ahead of the pack.

Similarly, Mauritian lender, SBM Bank has acquired Fidelity Bank and carved out assets from collapsed Chase Bank where it booked a Sh3.82 billion bargain gain.

KCB and Equity are not taking it lying down and KCB chief executive Joshua Oigara now says he wants to use acquisitions to accelerate the group’s growth.

The two lenders are now are in a neck-and-neck competition to deepen control not only of the Kenyan market but the region too through acquisitions.

KCB is now on its way to completing a deal to acquire part of Imperial Bank. In a quick follow-up, the bank also announced a deal to acquire a 100 per cent stake in National Bank of Kenya.

“The proposed transaction will further consolidate the banking sector in Kenya and will create stronger institutions, enabling KCB to play a bigger role in the financial inclusion agenda,” Business Daily reported Mr Oigara saying about the deal.

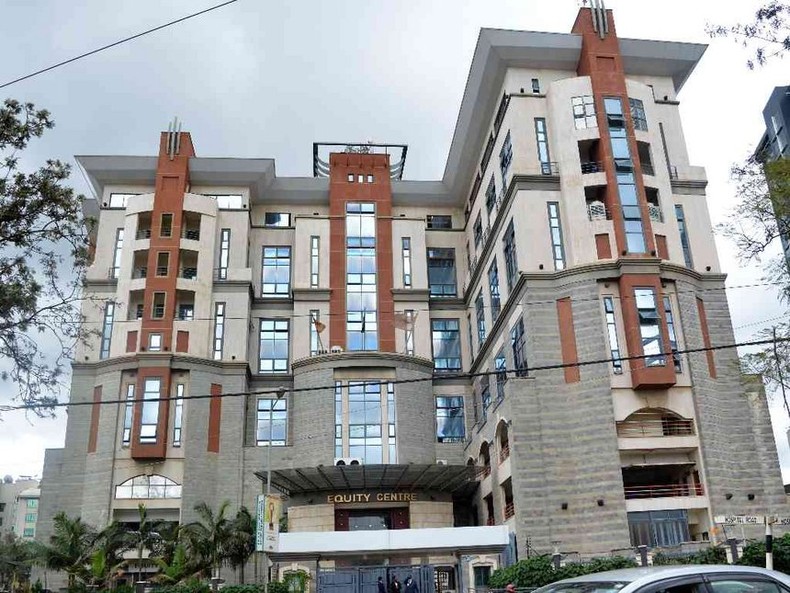

Hardly two weeks later, Equity Bank CEO Dr James Mwangi announced a Sh10.6 billion plan to purchase banking businesses in Rwanda, Tanzania, Zambia and Mozambique, adding two new countries to its portfolio.

Currently, KCB has 258 physical branches, 946 ATMs and 16,642 agents who are spread out in Kenya, Uganda, Rwanda, South Sudan, Burundi and Tanzania. KCB also has a representative office in Ethiopia.

On the other hand, Equity rides on 290 branches, 694 ATMs and 42,635 agent outlets, with a presence in Kenya, Uganda, South Sudan, Tanzania, Rwanda and DRC.